Trusted Apostille, Notary, NSA and Certified Translation services

Seamless Apostille & Notary Solutions You Can Count On.

Serving Jax since 2012

904-993-5100

Fast, reliable, and compliant document authentication so your paperwork is accepted worldwide.

Serving all 50 states with expedited and regular processing options.

Apostille & Document Authentication Services

In office and Mobile Notary Services

Apostille

Services

Certified NSAs

Loan Closing

Certified

Translations

State & Federal

Coverage

Internationally

Recognized

Clear & Simple

Process

Fast

Turnaround

In office and Mobile Notary Services

Apostille

Services

Certified NSAs

(Loan Signings)

Certified

Translations

State & Federal

Coverage

Hague Apostille Convention compliance - valid in 120+ countries. 120+ countries. .

Internationally Recognized

Hague Apostille Convention compliance, legalization services available for Hague signatory nations.

Clear & Simple

Process

Full service: notarization, courier, embassy submissions.

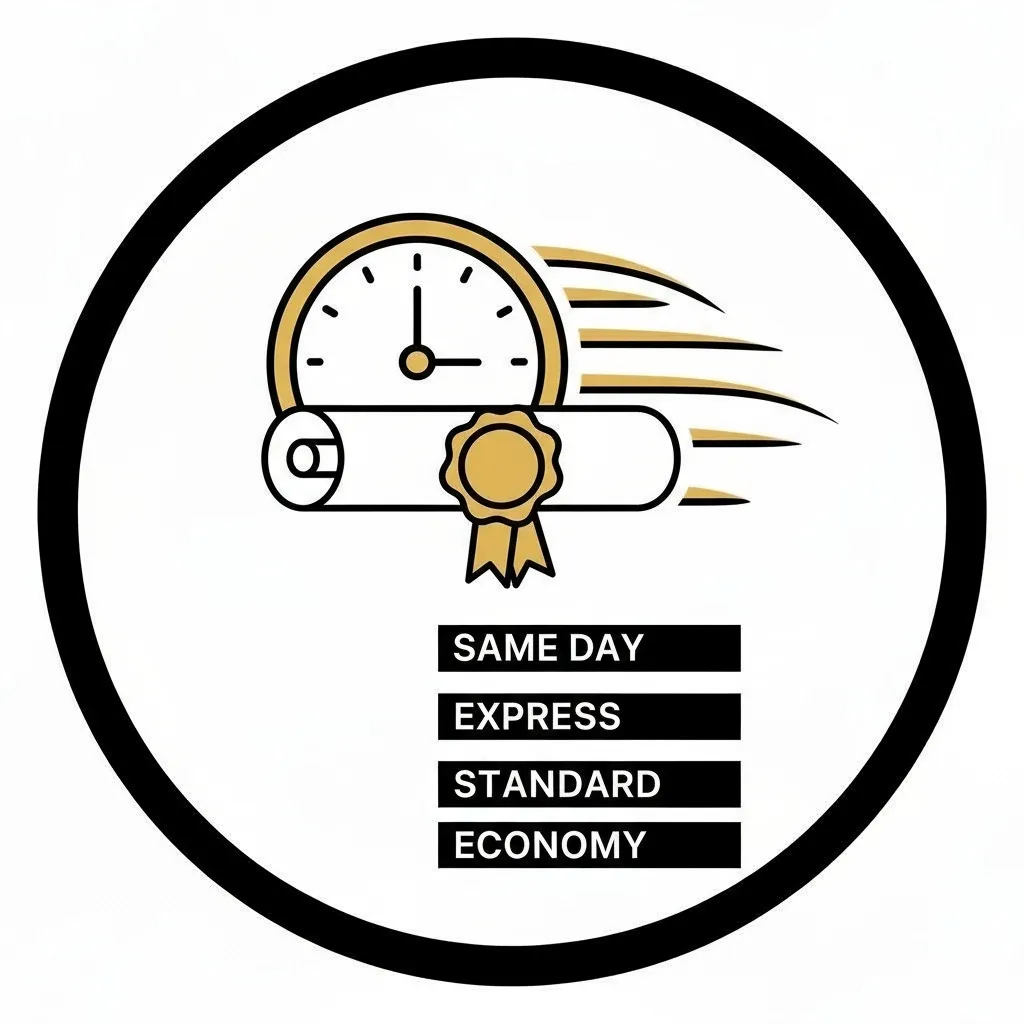

Fast

Turnaround

Options: Same day service, 3–4 day express, 5–7 day standard, 10–12 day economy.

Apostille & Document Authentication Services

In office and Mobile Notary Services

Apostille

Services

Certified NSAs

Loan Closing

Certified

Translations

State & Federal

Coverage

Internationally

Recognized

Clear & Simple

Process

Fast

Turnaround

In office and

Mobile Notary Services

Apostille

Services

Certified NSAs

Loan Closing

Certified

Translations

State & Federal

Coverage

Hague Apostille Convention compliance - valid in 120+ countries.

Internationally Recognized

Hague Apostille Convention compliance, legalization services available for Hague signatory nations

Clear & Simple

Process

Full service: notarization, courier, embassy submissions.

Fast

Turnaround

Options: Same day service, 3–4 day express, 5–7 day standard, 10–12 day economy.

State & Federal Coverage

Apostilles for all 50 U.S. states + federal documents through USDOS in D.C.

Internationally Recognized

Hague Apostille Convention compliance - valid in 120+ countries

Clear & Simple Process

Fast Turnaround

Options include 3–4 day express, 5–7 day standard, and 10–12 day economy.

We Do Much More!

Thorough Review First

We verify every document before billing, preventing costly errors and rejections in 120+ Hague member countries.

Expedited Processing

Express service in 3–4 business days available. Shipping to Tallahassee ...........included. d. Tallahassee included.

Translations and Approvals

Certified translations provided and emailed for your approval before submission, ...no surprises. ..................................

Worldwide Delivery

We handle international document return securely—via courier or certified mail ..........................................................

Specialized Services

For non-Hague countries, we handle embassy legalization post-apostille. .............................................................

TESTIMONIALS

What Our Clients Say About Our Exceptional Services

I was a bit apprehensive to begin with, as I didn't understand how it all works and was completely baffled. However, Veritas Authentications guided me through the process and patiently explained everything I need to know. I couldn't have done it without him.

Dwayne Smithson

CEO

I don't believe I have ever experienced such great customer service. Any time I had a question or was unsure about something, they were just a phone call or quick email away, willing to do everything they could to help me. Highly recommended!

Wendy Cormana

Manager

Although I'm usually a hard man to please, Karl and his team were excellent. They offer such a quality service that is second to none and goes beyond all expectations. I will definitely be recommending this company to everyone I know.

Ralph Sanchez

Analyst

Your Questions Answered

Expert Guidance on Apostille & Notary Services

We know international paperwork can be confusing. That’s why we’ve compiled answers to the most common questions so you understand the process and feel confident your documents will be accepted worldwide.

What is an apostille and when do I need one?

An apostille certifies your document so it’s legally recognized in Hague Convention countries. Without it, many international authorities may reject your paperwork.

Which documents can be apostilled?

Birth, marriage, and death certificates, diplomas, powers of attorney, corporate records, notarized affidavits, and more.

What if the country I need is not part of the Hague Convention?

In that case, your documents require embassy or consulate legalization. We manage that process from start to finish.

How long does the apostille process take?

Standard processing usually takes a few days, but expedited and even same-day services are available depending on the document.

Do my documents need to be notarized first?

Some do, some don’t. We review your paperwork up front and guide you so nothing gets delayed.

Can you handle translations as well?

Yes, certified translations can be arranged and sent to you for approval before filing.

How do I submit my documents to you?

Many can be handled via email. Originals, when required, can be mailed, and completed documents can be shipped back anywhere in the world.

Our Address

Location: Riverplace Tower,1301 Riverplace Blvd. Suite 800, Jacksonville Florida 32207

Phone: (904) 993 5100

Email: [email protected]